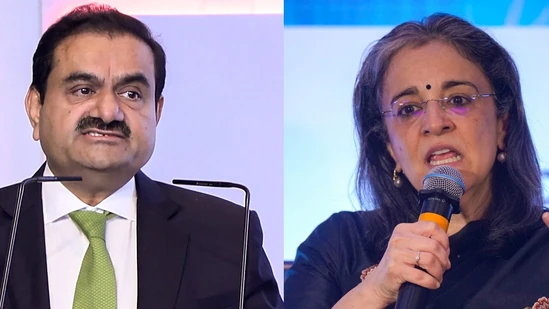

A seismic report from Hindenburg Research has sent shockwaves through India’s financial landscape, exposing alleged conflicts of interest at the highest levels of the regulatory ecosystem. The report directly implicates the Securities and Exchange Board of India (SEBI), its chairperson Madhabi Puri Buch, and her husband Dhaval Buch, who previously held a senior advisory role at Blackstone, a major player in India’s burgeoning REIT market.

At the core of the allegations is the claim that SEBI, under the leadership of Madhabi Puri Buch, aggressively promoted REITs as a lucrative investment avenue while simultaneously benefiting from her husband’s involvement with a key player in the same sector. The report further alleges that several regulatory decisions, including the introduction of nomination rights for REIT unit holders, were specifically designed to favor private equity firms like Blackstone.

These claims have ignited a fierce debate about the independence of regulatory bodies, the transparency of the REIT market, and the potential for conflicts of interest to undermine investor confidence. The report has raised serious questions about the integrity of the regulatory process and the extent to which personal interests can influence policy decisions.

Blackstone has vehemently denied any wrongdoing, but the accusations have cast a long shadow over the firm’s reputation. The controversy has also highlighted the growing influence of private equity firms in India’s financial landscape and the need for stricter regulations to prevent conflicts of interest.

As the investigation unfolds, the implications for the Indian financial ecosystem are far-reaching. The outcome of this scandal could lead to significant reforms in the regulatory framework, increased scrutiny of REITs, and a heightened focus on corporate governance. Investors are watching closely, as the credibility of India’s financial markets is at stake.

The Hindenburg report has sparked calls for a thorough and independent inquiry into the matter. It remains to be seen whether the authorities will conduct a comprehensive investigation and take appropriate action to restore public trust in the financial system.