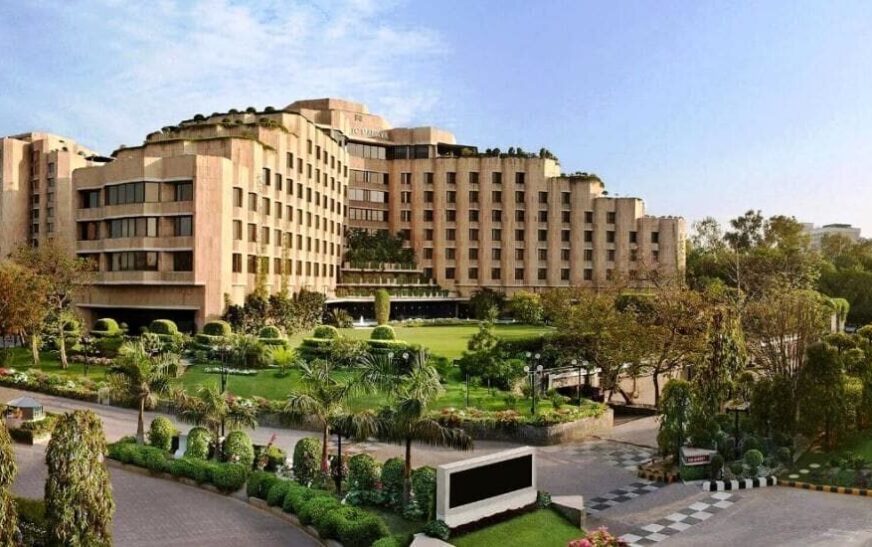

The iconic ITC Maurya hotel in New Delhi has received a temporary reprieve in its ongoing ground rent dispute with the Delhi government’s Land and Development Office (L&DO). A recent Delhi High Court ruling has placed a stay order on a hefty demand of Rs 111.06 crore, which the L&DO had imposed for the past 25 years of ground rent. This decision provides ITC with a vital opportunity to present its case and potentially reach a more favorable agreement with the government agency.

The dispute centers around the interpretation of the original lease agreement signed in 1975 when the land was allocated for the hotel’s construction. The L&DO claims that the agreement stipulates a specific, high ground rent, which ITC allegedly failed to pay for the past quarter-century, resulting in the substantial demand. However, ITC vehemently disagrees with this interpretation, arguing that the lease terms establish a different ground rent amount, significantly lower than what the L&DO is claiming.

The High Court’s intervention effectively halts the immediate payment of the disputed ground rent until further hearings are conducted. Additionally, the court has put a hold on two demand notices issued by the L&DO earlier this year. This temporary reprieve offers ITC valuable time to present its case and potentially negotiate a more agreeable ground rent structure with the L&DO. The outcome of this legal battle holds significant implications for the hospitality industry, particularly for establishments operating on leased land and facing similar disputes with government agencies. A favorable ruling for ITC could set a precedent for future ground rent negotiations, offering potentially more favorable terms for the hospitality sector.

This legal battle highlights the importance of clear and unambiguous lease agreements. Precise and well-defined terms can help prevent future disputes and ensure a smooth relationship between landowners and tenants. The hospitality industry will be closely watching this case, as the outcome could have a significant impact on ground rent considerations for hotels and other establishments operating on leased land.